Hear why the OECD has passed Legal Instrument 0467 compelling the US & 40 other countries to adopt tontines.

FEATURED

May 1, 2023

00:45 min read

OECD: Tontines are better & are coming soon

Dean McClelland

Tontines were on the agenda at the joint Webinar by OECD and the Arab Pensions Conference to discuss the future of pensions as set out in the OECD Pensions Outlook Report which is published every 2 years to guide pension policy makers at their 37 member states.

Chapter 6 of the 2020 report set out guidance notes in regards to the benefits of risk sharing tontines and tontine annuities for governments, issuers and retirees concluding that they "offer real benefits... even without an external guarantee from (an insurer). This means that all participants can increase their retirement income".

Crucially, Mr Antolin & his team have ratified our stance that tontine pensions should ensure absolute fairness and should be constructed to reduce or avoid the problems associated with other proposed collective risk sharing schemes such as 'collective defined contribution' pensions.

Watch the video excerpt on Tontines here.

Chapter 5 of the updated 2022 report can be read here.

The full OECD Pensions Outlook report can be purchased here

Our thanks to Ebrahim K Ebrahim, Chairman of the annual Arab Pensions Conference & his team at Fintech Robos for hosting this important event, the full version of which can be viewed here.

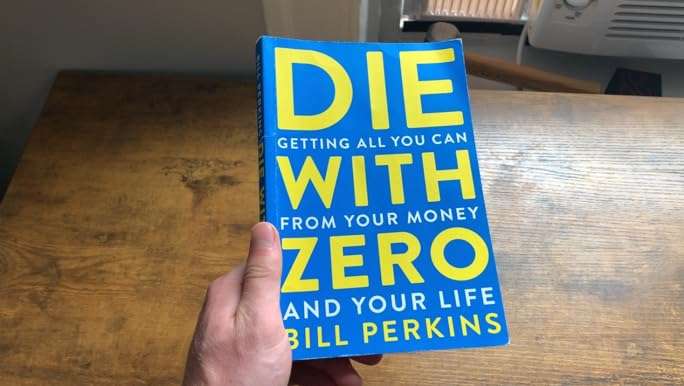

Book Review: Die with Zero by Bill Perkins

The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Opinion: DoL must regulate IRA accounts

Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed