Brought to you by the team featured in:

A proven model from history, redesigned for modern life

For centuries the tontineA tontine is a longevity-risk sharing arrangement linked to a living person (the 'member'), under which periodic distributions are paid for as long as the member is alive. Distributions are not guaranteed and may vary over time based on asset performance and the survival of other members. As members of a tontine class pass away, their remaining trust balances are redistributed among the surviving members, which affects future distributions. was how groups of people throughout the world planned for lifetime spending by sharing their longevity risk.

The key? Leftover monies are shared among those still living.

Tontine Trust has revived this simple time-tested concept using modern trust structures and digital administration.

Our Tontine Trust Funds apply the tontine principle to provide lifetime payouts that adjust naturally over time based on asset performance and who remains in the group.

How It Works

The simple, proven solution to a timeless problem

Form the Trust Online

Members establish and contribute to their individual irrevocable trust.

Monthly distributions may begin from a date selected by the member, in line with the terms of the trust.

The Tontine Begins

The leftover balances, together with asset performance, help power the lifetime payouts.

The Über Tontine

When the average age of a Tontine Class reaches 100, the class is combined with the Über Tontine.

The Über Tontine continues over time and supports ongoing payouts for very long-lived members.

This is a trust arrangement, not an investment product, and it does not guarantee returns or results.

Why do people choose a Tontine Trust?

Tontine Trusts are a smart, fair way to secure a steady income for life.

Lifelong Income, Made Simple

- Contribute to your trust as often as you wish,

- Select a reserve asset for your trust,

- Choose the income profile that works for you,

- Use the app to set and update the income start date,

- Start receiving monthly income automatically.

Enjoy Flat Low Fees

- A 1% annual fee covers the costs,

- No set-up costs or hidden charges,

- No commissions for agents,

- = More of your income comes to you.

Effortless, Secure Access

- Login via the website or the mobile apps,

- No passwords to forget - just login with your face,

- Update your receiving bank account any time,

- Appoint your trusted person in case of emergency.

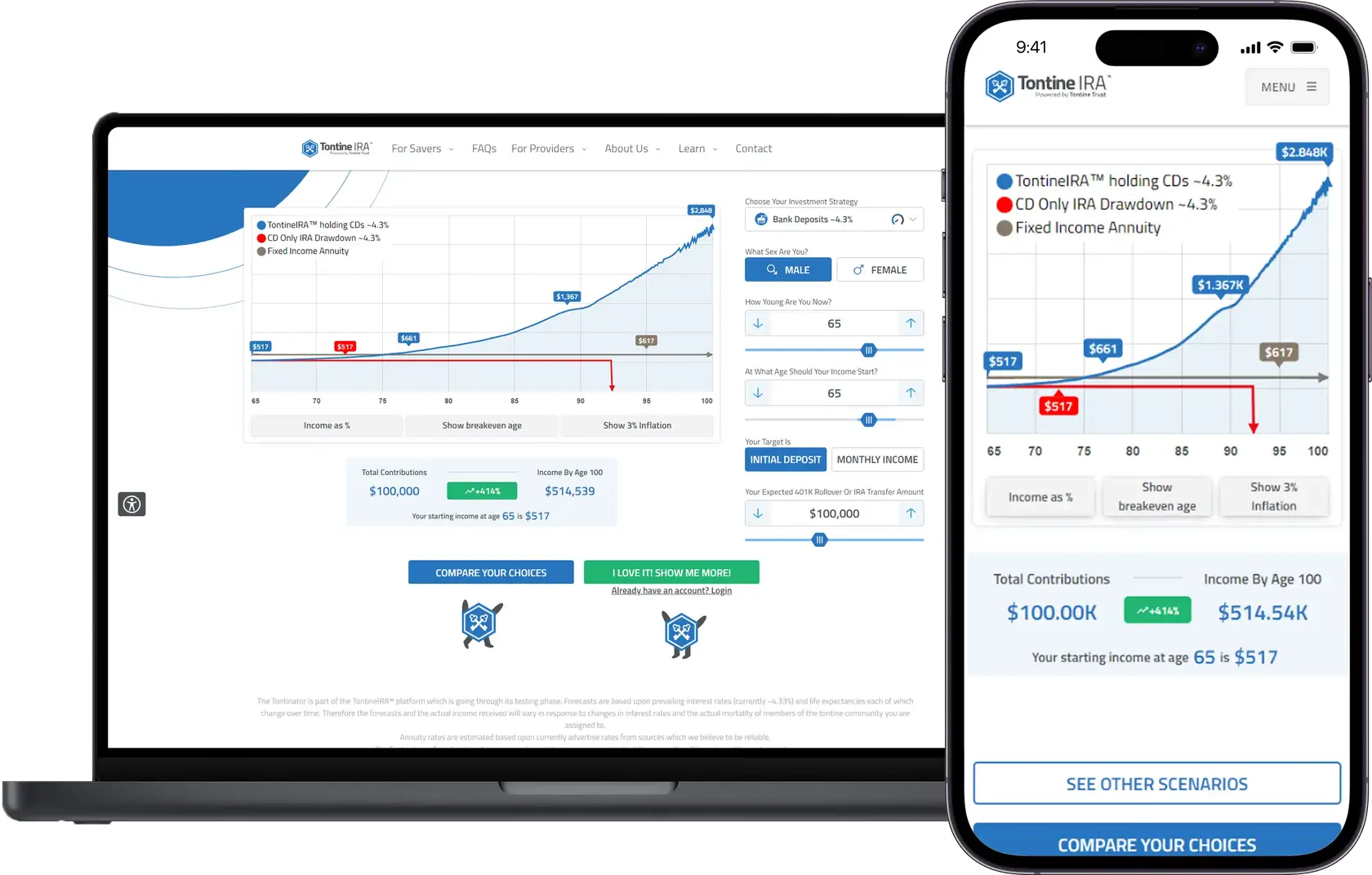

Use the 'Tontinator' to illustrate potential income

Estimates are based upon mortality rates and asset values which change regularly

The Tontinator is part of the MyTontine™ platform which is going through its testing phase ahead of launch.

Forecasts are based upon the expected rate of return of the selected assets and average life expectancies each of which change over time.

Therefore the forecasts and the actual income received will vary in response to changes in the actual and/or expected rate of return and the actual mortality of members of the tontine class that you are assigned to.

Annuity rates are estimated based upon currently advertised rates from sources which we believe to be reliable.

The Tontinator is for educational purposes only and there is no guarantee that these results will be achieved by each member.

Savers should consider their personal risk tolerances before considering any investments and should consult a financial advisor where appropriate.

Easy to setup

Your Trust Fund can often be established and funded within 15 minutes

Design your Plan

Estimate your potential contributions, choose a reserve asset, choose an income level and when you want the income to start being distributed.

Fund your Trust

Once you pass our onboarding process, you can start contributing through a local currency account in your name at one of our partner banks.

Relax & Start Living

People with lifetime incomes are happier and live up to 20% longer than those living in fear of running out of money according to research

Watch and learn how Tontines are different from other lifetime income plans.

Our global banking infrastructure

Borderless - Global Payments

A state-of-the-art payments network that enables financial institutions to transfer money globally at far greater speed and lower costs than the SWIFT network.

BitGo - Global Custodian Bank

BitGo Bank & Trust is a leading global qualified custodian securing $100 Billion of assets on behalf of 1,500 institutions.

Supported currencies:

more coming soon...