Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed

Jan 3, 2024

02:00 min read

Opinion: DoL must regulate IRA accounts

Kerry Pechter

Kerry Pechter is the author of Annuities for Dummies, Editor of the Retirement Income Journal and the former Head of Communications for Vanguard.

In January he published a great post which exposes the hypocrisy of the annuity industry in terms of how they treat customers. It's worth a read:

*Perhaps you've seen the flurry of press releases from various financial industry groups attacking the Dept of Labor's proposal to raise the bar for adviser/agent conduct on rollover recommendations and annuity sales. How long has this been going on? Long enough.

We have America's splintered financial regulatory system to thank, which gives the 50 state commissioners jurisdiction over fixed annuities, SEC over securities, both SEC and state authority over variable annuities, the Department of Labor authority over qualified plans, and Bermuda over reinsurance.

Lots of legal cracks, crevices and loopholes between them. Most perplexing for the public is the ability of an adviser (as in the Cutter Financial case) to switch hats and sell annuities as an agent and investments as an adviser. So far, the investing public has been the biggest loser in this balkanized system; thousands or even millions of them are paralyzed by the inability to find someone to trust with their retirement money.

Regarding the annuity issue, the argument that the state monopoly on insurance regulation immunizes agents from DOL oversight is incoherent to me. I don't get it. That's like saying I can operate on this person's brain because I'm not a doctor, and not beholden to the AMA. So far, I notice no one sharing the industry's position except the industry and its attorneys.

And when I hear people citing the 2018 5th Circuit decision as the last word on the issue, I wonder if they've read the decision. Yes, the industry got the ruling it shopped for. But the judge seemed not to understand that annuities are sold, not bought, and overrated the acumen of the client. And the DOL didn't bother appealing the decision to the whole 5th Circuit panel. Why would it, when the new Secretary of Labor was the winning attorney in the case.

The DOL has not only the right but the obligation to regulate conduct with respect to owners of qualified accounts, regardless of whether the agent is selling annuities or vacuum cleaners or mechanical monkeys.

And the idea that agents are looking out for the little guy who can't afford an AUM adviser? Words fail... In terms of adviser/agent conduct toward clients, the race to the bottom should be long over.

We need a race to the top instead.*

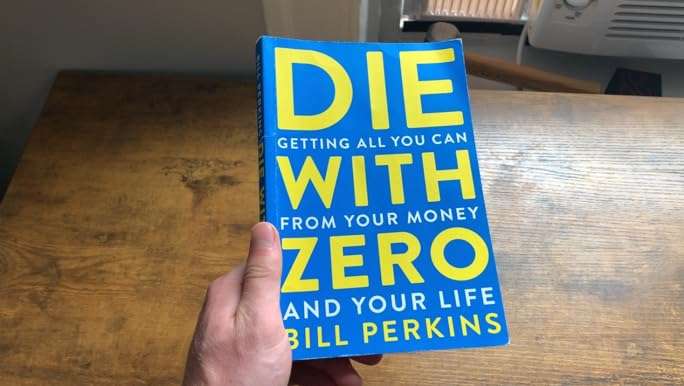

Book Review: Die with Zero by Bill Perkins

The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Canada joins the global shift to tontine pensions.

Following on the heels of the OECD recommending that tontine pensions become mandatory, Canada is backing tontines