US think-tank Brookings is calling for pensions to be more equitable & that tontines have an important role to play

Aug 18, 2021

02:00 min read

A pensions new deal? Brookings backs tontines…

The highly respected American economics think-tank Brookings has joined the growing list of research institutions calling out the need for better, more equitable pensions. And like the vast majority, they agree that tontines are part of the solution.

In its new book entitled, “Wealth after work: Innovative reforms to enhance retirement security” Brookings describes a US pensions landscape crying out for stronger products that address the widening wealth gap in American society.

In line with the prevailing school of thought among academics and commentators, it urges that more be done to tackle the structural racial and gender inequalities that are condemning many millions of lower-paid Americans to suffer highly uncertain financial futures. Indeed, enabling the less well-off to retire richer and with confidence is now seen as one of the most fundamental challenges facing society today.

The first hurdle to climb, according to Brookings, is encouraging mass access and participation. This can be achieved by encouraging auto-enrollment and automatic contribution increases for occupational schemes, something that is already in train in some US states.

The next challenge is to help people understand the pensions system more easily. This could mean offering them more comprehensive information, assisting them with managing their savings, or simply providing them with the tools to help them administer multiple benefits.

Brookings’ final proposal is for the provision of “better options for generating reliable income and managing savings during retirement”. Here, it cites “tontine-like pooling of longevity risk” among its three main options.

At Tontine Trust, we naturally concur that the pooling of longevity risk is by far the most effective, indeed only, way of securing reliable and rising lifetime income benefits. But our MyTontine product, with its simplicity, transparency and low cost is also brilliantly able to solve the accessibility issue that Brookings correctly highlights as being the weak link in the private pension system currently.

Read the full Brookings article here.

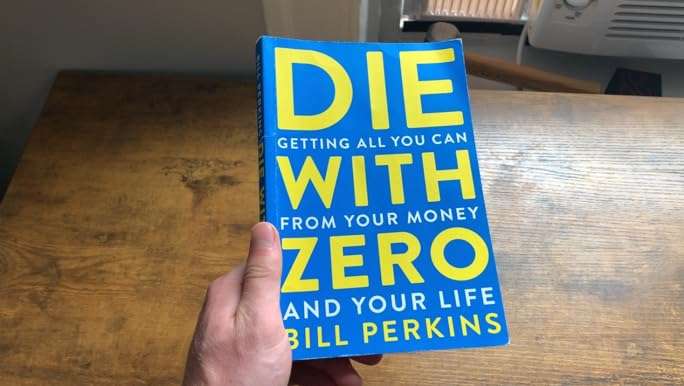

Book Review: Die with Zero by Bill Perkins

The aim of the book is to help you shift focus from maximizing wealth to maximizing life experiences.

What Is a Tontine? Should You Invest In One?

Ruth Saldanha asks: Is a Tontine the Best Way to Get Income in Retirement?

Opinion: DoL must regulate IRA accounts

Kerry Pechter, author of Annuities for Dummies & editor of the RIJ explains why new rules on annuities are needed